Aug 23, 2020 COVID’s Impact on Move Pricing (and what you can do about it)

By Ryan Keintz

COVID has disrupted the steady, mostly predictable rhythm of supply and demand worldwide, an impact that has been felt notably within the household goods moving industry. Costs are going up for movers in order to allow for more planning time, providing PPE and sanitizing products, and taking extra steps in the home.

One of the biggest challenges for movers and RMCs to navigate recently has been logistics, particularly air and ocean freight. It’s no longer as simple as obtaining a quote and booking space on a plane or ship. Managing moves, partner networks, and pricing during COVID is a complicated challenge with dynamics that change daily.

We’ve been through six months of this new order, and while the pricing environment remains volatile, we’re starting to see some trends emerge from our metrics and dashboards. At the outset of COVID there was a sharp spike in road and sea shipments, but these have since fallen to below where they were a year ago.

Here are some of the more lasting impacts for you to be aware of…

Air freight shock waves

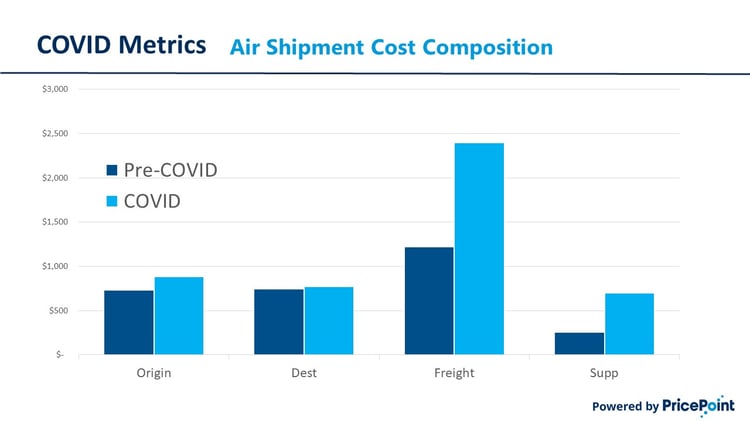

Air freight logistics and pricing have become particularly volatile. The airline industry is suffering massively under COVID, and with far fewer passenger flights in operation, the auxiliary freight capacity afforded by commercial flights has also disappeared. Now, forwarders are almost completely reliant on freight carriers. Current air freight pricing is reflecting this spike in demand and limited capacity. Freight costs are averaging double what they were pre-COVID, and there’s been a nearly three-fold increase in supplemental charges on air freight moves. The average air shipment has increased 26% compared to rates prior to Q2 2020.

Ocean versus air: finding a balance

Everything moves slower with ocean freight, including increases in price. With air freight, carriers are going to try to fill their planes with cargo that’s going to pay the most, whereas steam ship lines will typically give 30 days’ notice before they will issue increases. On the flip side, ocean freight has experienced an imbalance in the general movement of cargo worldwide. With full containers not returning empty in a timely manner, it’s containers, not capacity onboard the ship, that have become the precious commodity. For the time being, ocean freight has stabilized, but this may also be impacted in future as quarantines move from country to country.

Shortened terms and rebids

With such volatility in pricing and capacity, it’s become extremely difficult to honor quotes for more than a month, and contingencies can no longer be covered by padding a few extra points into the quote as before. Risk now needs to be managed in real time, and some within the industry are responding by requesting rebids for moves. This causes an enormous amount of extra work for everyone involved, and ultimately, that cost gets passed back to the customer.

The way we suggest this be managed is with a special COVID supplement, as it adequately responds to the needs of everyone involved: it allows movers to cover costs, saves significant workload, and identifies where increases are coming from. A couple of weeks ago we brought you a piece that explored how trust can be built when there is transparency in pricing. Implementing a supplemental fee that responds to the variances and uncertainties brought on by COVID can build elasticity into your pricing, drive efficiencies, and provide valuable insight.

Data, transparency, and clarity for the future

We’re in it alongside everybody else. We don’t really know what is going to happen with pricing, how long the uncertainty and volatility will persist, what’s going to happen with air and ocean freight, or with road freight in the EU versus road freight in US.

Through our analysis of scorecards and a few years of reporting, we have observed that RMCs and movers who adopt open conversations with one another end up with fairer – and often lower – pricing in the long run. Now maybe more than ever, pricing is an indicator of the health of relationships a mover has with its forwarders, illustrating who is using their connections and expertise the best. Allowing movers to insert a supplemental to adjust for extra COVID-related costs will keep them from needing to make up those costs elsewhere. Post-COVID, having special supplemental identified as a separate line item that can be removed will create trust between partners and prevent what could potentially become an industry-wide price hike.

Looking to mitigate increased moving costs due to COVID?

Founder and President. After a career pricing for the largest international movers, Ryan observed that price manipulation was a more critical success factor than customer service or logistical expertise. He created PricePoint to fix a broken system.