Oct 8, 2021 Can COVID Cure Contract Pricing?

By Ryan Keintz

Evolution from constraint

We’re in the midst of economic and social shockwaves brought on by COVID and an array of subsequent administrative policies. While challenging, the hardship and constraints we’ve experienced have also provided massive impetus for innovation. As crisis constraints gradually subside, we have the opportunity to retain some of the learned adaptions, recognizing those which are worth keeping around.

As an example of how constraints can drive innovation, PricePoint began with 1.5 employees and a bootstrap budget. Cost constraints made it clear that office space rent was easily avoidable. As we grew and hired more employees, we saw no need to change course, and naturally became early adopters of remote work. Not only did we keep our budget lean and SaaS overhead low, but we also removed the geographic constraint of hiring. That turned out to be a major advantage, allowing us to cherry-pick ideal new hires without worrying where they live. Consequently our decentralized team is networked across five countries and six US states.

In contrast, most businesses were reluctant to embrace remote work opportunities pre-COVID. Granted, the general reluctance is understandable because constraints vary business-by-business and job-by-job. Then came COVID, upending the status quo constraints. The game changed, remote work adaptation occurred rapidly. Things are slowly getting back to “normal”, but it will be a new normal. These crisis constraints highlighted the benefits of alternative ways of work for both employer and employee. As those constraints recede, hybrid business models will evolve that hadn’t been previously considered.

Increasing need for dynamic pricing

So what does this have to do with the contract pricing in the moving industry? My hope is that COVID’s economic impact will be the catalyst to end our industry’s reliance on contract pricing.

COVID’s impact sent shockwaves through countless industries, disrupting supply chains and the sophisticated clockwork mechanisms of the global economy. With our supply chains disrupted and logistical efficiencies degraded, there has been unprecedented and ongoing freight price volatility. I’ve read dozens of articles like the enclosed Bloomberg example. The consensus is this trend will continue well into 2022 with no certain resolution on the horizon.

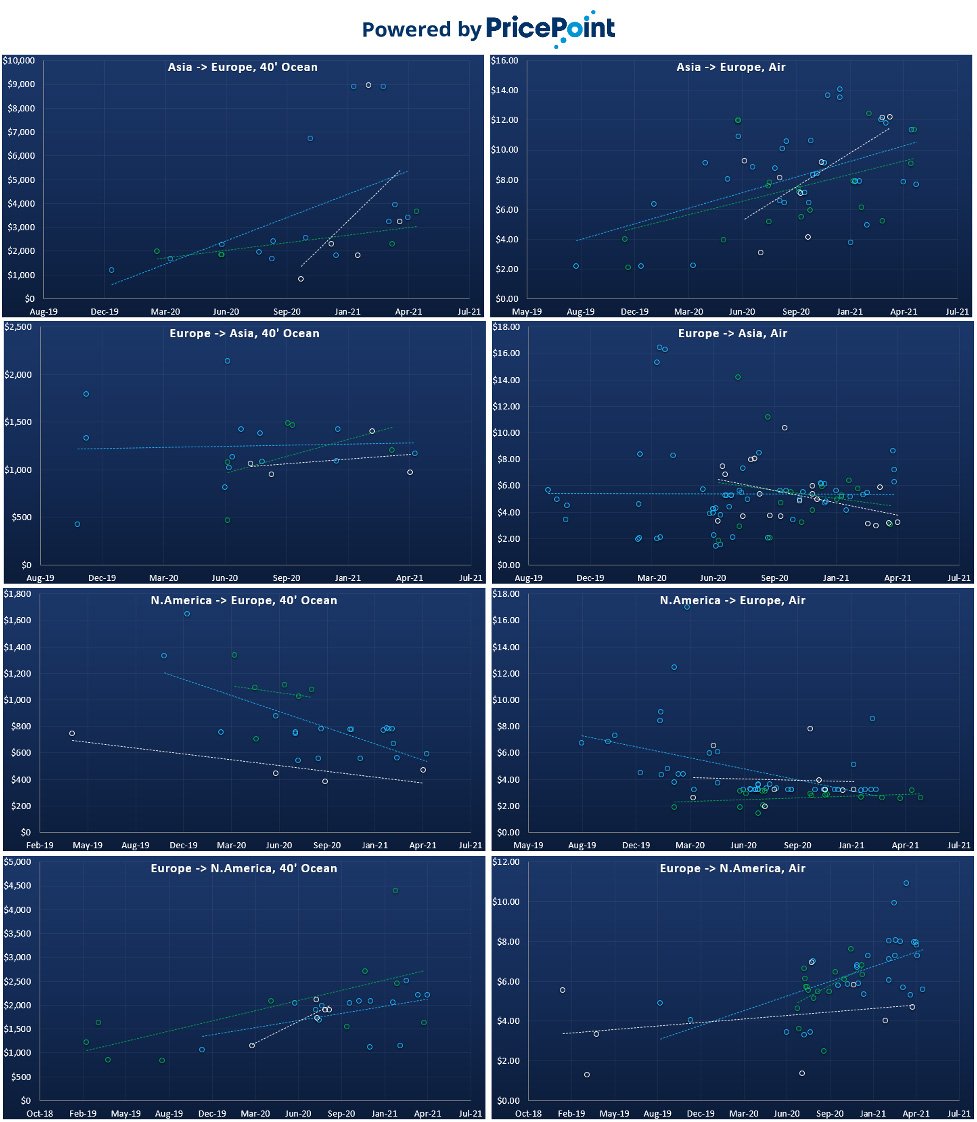

Our international PricePoint Portal data also shows this significant price volatility. I analyzed data of moves from our corporate/RMC clients for the most frequented trade lanes. As our model isolates freight cost (for better price transparency), I was able to scatter-graph freight prices for the chosen trade lanes. On the charts below, the left are 40’ container sea freight prices, and the right are airfreight prices per kilogram. Each color (blue, green, white) represents a particular trade lane. Dashed trendlines illustrate the overall trajectories.

Of particular note is the scale of price volatility along the Y-axis. Every region experienced a 4-figure cost fluctuation over 18-24 months. That period is shorter than most conventional corporate-mover pricing contracts. That represents an alarming financial exposure for service providers when gross margins are commonly 3-figure per shipment.

When an industry experiences non-recoupable cost volatility that is order-of-magnitude larger than profit margins, it’s time to find a new solution.

Contract pricing locks suppliers into a fixed price for multiple years. Clients like contract pricing because it provides price certainty. However this ignores the externality of service quality becoming a variable when price is the constant. In today’s volatile environment, suppliers risk losing thousands of dollars per shipment. This presents the supplier with the dubious options of sacrificing service quality or deploying sketchy invoicing tactics to stay above water (as previously discussed).

Many corporate clients are allowing movers to add COVID surcharges to their contract rates. But this is a band-aid fix and demonstrates how ill-suited contract pricing is for today’s new normal.

Freight price volatility has proven contract pricing to be untenable, and companies must adapt. Contract pricing made sense when we were dealing with the old set of constraints. The past constraint was a lack of technology, which was manageable when price volatility was not a significant constraint. Now, those two constraints have inverted. We have smart technology (like PricePoint) to help suppliers and clients respond to the ebbs and flows of real-world conditions. Just as there was a swift uptake of tools to support remote work, companies should embrace dynamic pricing to future-proof their supply chain.

Focus on the solution instead of the contract

I’ll summarize with an explicit message. Movers, if you are ready to stop being locked into rigid multi-year contract pricing, you must offer your corporate clients a viable alternative. It cannot be “just trust us, we’ll charge you fairly.” Your clients need independent assurance of fair pricing. Your mobility partners need to satisfy proof of value to their bosses and procurement departments. If you would prefer that assurance to come in the form of invoice audits (#financialproctology), then vaya con dios. A better solution is to offer clients a transparent and trustworthy pricing model that is flexible to market conditions, ensures pricing integrity, and delivers independent metrics of value.

That mover-friendly alternative is PricePoint. Contact us and let’s fix the future.

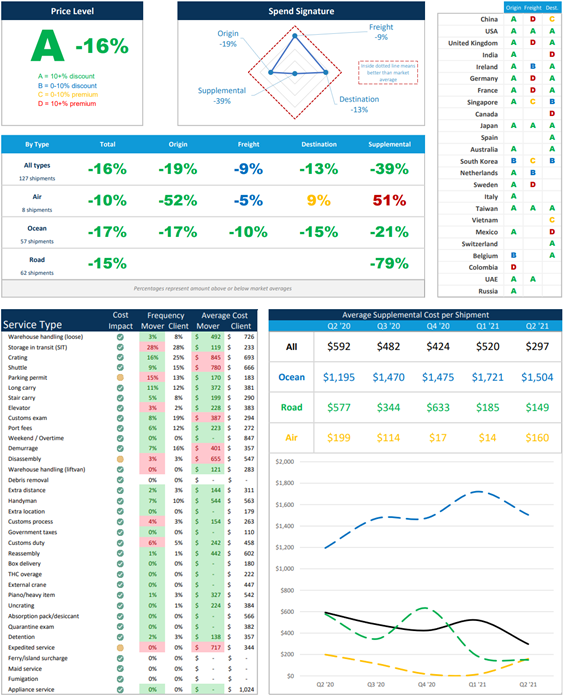

Example PricePoint Quarterly Scorecard

Founder and President. After a career pricing for the largest international movers, Ryan observed that price manipulation was a more critical success factor than customer service or logistical expertise. He created PricePoint to fix a broken system.