Aug 8, 2023 Caught Offside: Transparency Proves Foul Play in Moving & Relocation

By Ryan Keintz

The four boys in our household are members of five soccer teams. We watch a lot of soccer. Setting aside my belief that offside is a bad rule that turns the beautiful game ugly, I’m endlessly amused at the offending player/team/supporters incredulous response when the offsides flag goes up: “Who me???!!!!”

At PricePoint we often encounter similar disbelief when our data analytics prove poor cost management by suppliers. Whereas soccer offsides is frustrating because it’s subjective and prone to game-changing human error, when PricePoint raises the overspend flag, it’s based on objective hard data. We have the receipts, literally.

I’ve previously written about the myriad of pricing games that are decades-ingrained in the moving industry. The most common are the exploitation of supplemental charges. Supplementals are additional services (such as crating, long carries, shuttles, storage, etc.) that are typically excluded from upfront price quotes and RFP-based price agreements. Unsurprisingly, this opens up huge loopholes for supplementals to be overcharged.

Creating a Level Playing Field

As I always say, “don’t hate the player, hate the game.” Or better yet, change the game. PricePoint has changed the game and solved the scourge of supplementals with a simple solution and a dash of genius.

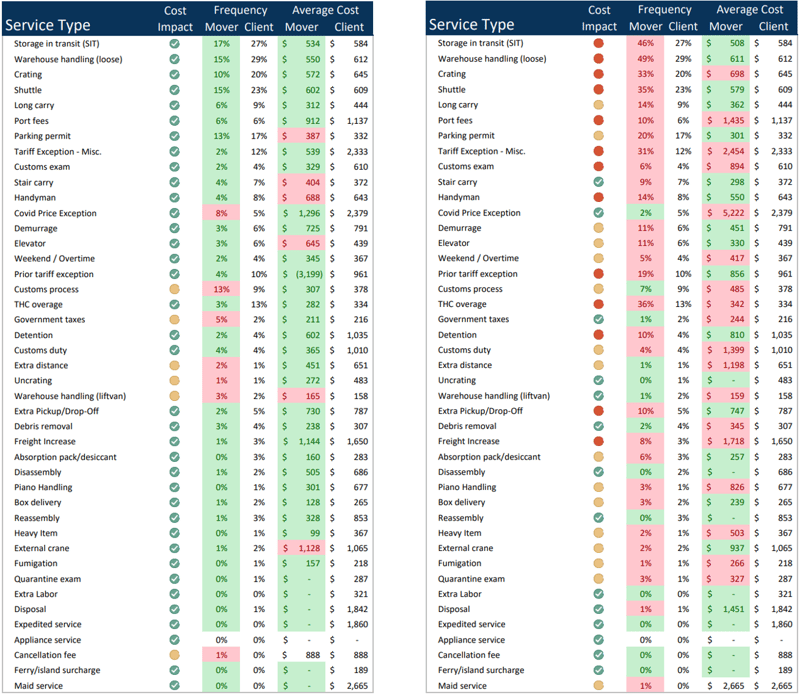

The simple part: measure it. As our corporate/RMC clients’ spend data flows through our Portal platform, we simply measure the frequency and average cost of all supplemental line items. We compare those spend levels across all suppliers and all clients, easily contrasting good vs bad performance in our quarterly benchmarking scorecards.

Can you spot the good vs bad cost management?

The genius part is how we feed this performance data into a self-policing incentive structure that avoids the need for tedious invoice audits (another plague in this industry). Moves are awarded to suppliers via competitive bidding in our Portal platform. When our data measures that Mover B typically charges $1500 more per shipment on supplementals than Mover A, our Best Choice algorithm adds that $1500 projected extra cost to Mover B’s future bids. The net result is that suppliers who effectively control supplemental costs will win an increasing portion of future bids. Suppliers who routinely overcharge will experience a reduction in bookings, which is when they start paying attention, incredulous that they’ve been caught offsides.

"You're winning less business because your supplemental charges are 125% too high."

Willful Blindness – The Relo-Scam Business Model

To be fair, I do believe the disbelief we often encounter from movers is sincere. Like I mentioned earlier, supplemental price manipulation is so commonplace that it easily goes unnoticed until it’s measured and actively managed. More so, the exploitation is often not being done by the “booker” who is the client’s direct supplier. Rather the overcharging happens further down the supply chain at the local agent level. Again, this is the natural outcome of a long history of poorly designed corporate procurement models that create opportunities for such exploits. In short, a corporate booker will typically communicate to their origin/destination agent “Hey I’m sorry but the client contract only allows us to pay you $45/CWT…” What’s unspoken or wink-winked is that the contract does not have price controls around supplemental services, from which agents can aggressively supplement their profit margins.

“All that crating was necessary!!!!”

Now that you see how the game is played, consider the truth hiding in plain sight: vertically-integrated RMC conflict-of-interests. If you are a corporate buyer who has 1) outsourced your moving services to an RMC, and 2) that RMC owns parts of the supply chain (moving companies, vanlines, forwarders), then your company has opted into a pure fox-guarding-the-henhouse supplier model. There is no incentive for the RMC side of the operation to police their own(ed) supply chain. There is instead an obvious inverse incentive in which the RMC is willfully blind to their subsidiaries’ “profit maximization” (a common industry term, see also “adding smack” and “shearing the sheep”). Adding insult to injury, if the RMC’s fee structure is cost-plus percentage-based, then the client is getting a double or triple-whammy on overcharges.

Vertical Integration Pricing Play

The local agent charges an inflated price for the supplemental service, which is marked up further by the booking mover (same company!), which is marked up again by the RMC (same company!)

So how much cost impact are we really talking about? A fair approximation is the Three Zeros Rule. Take your annual shipment count and add three zeros to estimate your overspend. i.e. A client with hundreds of moves per year (XXX) is overpaying hundreds-of-thousands of dollars ($XXX,XXX). A client with thousands of moves per year is overpaying in the millions.

If you’d like to keep the convenience of your RMC outsource but stop overpaying, let’s talk…

Founder and President. After a career pricing for the largest international movers, Ryan observed that price manipulation was a more critical success factor than customer service or logistical expertise. He created PricePoint to fix a broken system.