Sep 6, 2022 Supply Chain Shock Waves and International Freight Pricing Volatility

By Ryan Keintz

For nearly three years, the international mobility industry has endured incredibly volatile freight pricing brought on by COVID, the conflict in Ukraine, and most recently, the shutdown of inland transport waterways in Europe and Asia owing to the climate crisis. In the face of such dramatic spikes in freight rates, long-term, rigid pricing agreements have been rendered inadequate – if not outright useless. Buyers no longer have the safety net of binding contracts to rely on, eroding confidence in the pricing they are being charged and trust in their supplier network. Are such drastic price hikes justified or arbitrary? How can corporate/RMC purchasers be sure that they are being charged fair and market-competitive rates?

Shockwaves Continue to Disrupt the Supply Chain

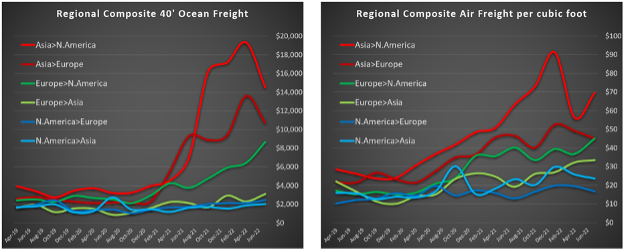

Let’s begin by putting our discussion in context. Here is the international freight cost data sourced from thousands of shipments managed via PricePoint Portal over the past three years.

Prior to 2019 and the shock of COVID, we saw relative price stability. Following the COVID pandemic, some regional trade lanes remained stable (Asia inbound / USA outbound), while others experienced dramatic inflation (Asia outbound / USA inbound). This can be attributed primarily due to global manufacturing and trade imbalances that actualize as supply vs. demand variance for freight capacity. Therefore, we saw that a 40’ container from USA to Asia would cost around $2000, whereas the same route in reverse spiked as high as $30,000.

Moving Spend Cost Constants

Freight is only part of the total move spend, which can be universally broken down into five core cost components:

- Origin services

- Freight

- Destination services

- Supplemental services (crating, shuttles, etc.)

- Coordination fee

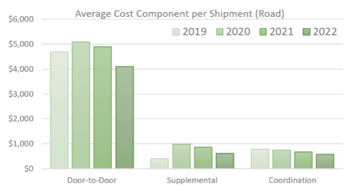

Not all components are experiencing similar volatility as freight. However there are interesting nuances we can see in the data. The following charts show PricePoint Portal’s entire data set sliced according to shipment type and the five cost components.

We see that extreme volatility is limited to the freight component. Origin and destination services have been relatively stable with mild increases and decreases. Supplemental costs did increase significantly due to COVID policies and supply chain bottlenecks, but they seem to have normalized in the first half of 2022. Lastly, coordination fees have stayed remarkably stable. The mild increase in ocean coordination fees is due to most movers basing their coordination fees on cost-plus percentage basis, so those fees have proportionally risen as a ripple effect of freight inflation. (Frankly the modest coordination fee increase is more than justified considering the myriad of logistical obstacles that move coordinators have been facing in the COVID era. We’ve heard from moving colleagues that move coordination admin time is 2-3X greater per shipment than pre-COVID norms).

For those interested in road shipment type (intra-Europe, etc.), the following chart combines origin-freight-destination costs into door-to-door. Road shipments were less impacted over the last few years. There was an initial moderate price increase in the early chaotic days of COVID in 2020. However, since then, prices have steadily declined (following the trend of shrinking shipment sizes). Again percentage-based coordination fees reacted proportionate to spend, lowering slightly.

You Can't Price Ambiguity Out of Contract

Conventional pricing models cannot adjust to such volatility because the shockwaves are spreading differently according to variables of geography, shipment type, and service component. Therefore, a conventional pricing agreement cannot simply be increased X% across the board.

Meanwhile, traditional pricing is typically structured as a total door-to-door bundled price. This means that even though cost volatility may be limited to one internal component (freight), the entire door-to-door price has been rendered irrelevant, because there was no transparency into the component costs from the outset. Therefore, the buyer cannot know the original freight cost vs. the new true cost. So, when the buyer releases the supplier from the historic contractual price, they have no assurance that an additional margin isn’t being opportunistically tacked onto the new price. And let’s be real, decades of conventional pricing models have incentivized and trained movers to aggressively exploit such ambiguity. Don’t hate the player, hate the game.

Build Confidence with Dynamic, Component-Based Pricing

There are two must-haves for a modern, effective, and trustworthy pricing model:

- It must be dynamic

- It must be component-based

Since PricePoint Portal was designed around these imperatives, I’ll explain using our model for context.

Dynamic pricing allows suppliers to update their pricing as often as necessary, responding to market conditions in real time. The mover is only bound to their PricePoint tariffs when actual shipments are booked on a current tariff. It’s quality-imperative to allow price to fluctuate along with real time market conditions. Otherwise, if price is treated as a constant, quality becomes the variable. If service quality is the priority, then price MUST be allowed to be dynamic with fluctuating market conditions.

Component-based pricing according to the five core costs is crucial, instead of bundled door-to-door, because volatility affects those components differently. Component pricing is win/win for buyer and supplier. For example, the cost charts above illustrated how origin and destination services were stable in contrast to freight volatility. Since PricePoint tariffs are filed and calculated at the component level, those origin/destination tariffs do not need to be updated nearly as often. This means low admin burden for the supplier, and cost stability for the client. The supplier only needs to update their single-factor freight rate rather than dozens of bundled door-to-door prices. At global scale, component-based pricing means updating mere hundreds of freight prices rather than millions of conventional door-to-door bundled prices.

Effectively negotiate fair pricing in a volatile supply chain market

With interest rates rising and global economic recession looming, buyers are becoming increasingly cost conscious, but ill-prepared to effectively negotiate fair pricing. Cost volatility will remain a reality for the near future, which renders traditional pricing models useless. As moving costs spike, corporate procurement and mobility buyers will need to answer difficult questions internally.

- “How do we know we’re not being overcharged?”

- “How do we negotiate competitive pricing going forward?”

These same questions apply to those who have outsourced to RMCs, whose core competencies do not include dynamic price management (sorry, truth), and have a glaring conflict of interest if the RMC is vertically integrated and owns portions of the supply chain that they themselves are price-managing.

Transparency is the only win/win solution. Buyers and suppliers must have a shared baseline of actual, real-time costs so they can credibly track and agree on justifiable price changes into the future. Without transparency, pricing agreements are like throwing darts blindfolded. Without transparency, trust is impossible.

Interested in bringing more transparency and trust into your moving supply chain?

Founder and President. After a career pricing for the largest international movers, Ryan observed that price manipulation was a more critical success factor than customer service or logistical expertise. He created PricePoint to fix a broken system.